Premium insurans kenderaan ditetap berdasarkan senarai faktor risiko mulai 2016

Menurut laporan yang disiarkan oleh The Sun, berdasarkan kenyataan yang dikeluarkan oleh Bank Negara Malaysia (BNM), premium insurans kenderaan akan ditetapkan berdasarkan senarai faktor risiko mulai 2016.

Pelbagai faktor risiko tersebut tidak termasuk tarif motor semasa seperti lokasi tempat tinggal, model dan tahun kenderaan, penggunaan kenderaan, pekerjaan, sejarah tuntutan, jantina dan umur akan diambil kira, yang sama seperti sistem yang digunakan di kebanyakan negara termasuk UK.

Dalam erti kata lain, premium isnurans akan ditetapkan dengan kadar bayaran mengikut faktor risiko, contohnya, pemilik kenderaan daripada jenama dan model dengan kadar kecurian dilaporkan tinggi, pemilik kenderaan yang berprestasi tinggi, atau mereka yang tinggal di kawasan berisiko tinggi berlaku jenayah perlu membayar premium yang lebih tinggi.

BNM turut memberitahu, pihak mereka akan bekerjasama dengan syarikat insurans untuk memperkenalkan tarif baharu dan meneliti kadar bayaran yang bersesuaian untuk dikenakan.

Indeed, according to the General Insurance Association of Malaysia (PIAM), in 2013, motor insurers paid out nearly RM1.3 billion in third-party bodily injuries (+12% over 2012), RM295 million in third-party property damage (+28%) and RM627 million in total for motor thefts (+21% over 2012).

That was last year. This year, in the first quarter alone, net claims paid out for bodily injury and property damage due to road accidents amounted to RM1.384 billion. Clearly, these contribute huge losses to motor insurers.

As such, the insurance and transport industries, along with motorists and other relevant agencies, should work together to promote safer driving, reduce accident rates and create greater awareness on road safety, BNM told The Sun, pointing out that in doing so, insurance payouts can potentially be minimised, leading eventually to lower premium rates.

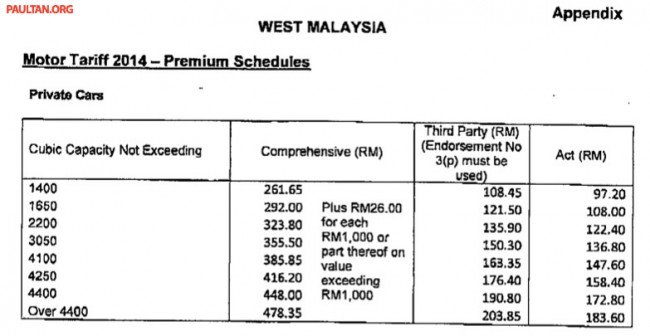

In 2011, the central bank announced the New Motor Cover Framework. Under this framework, Malaysia’s motor tariff premiums would be revised gradually beginning January 2012, to eventually culminate in the abolition of tariffs in 2016. Premium rates will then depend entirely on market forces.

Meanwhile, all general insurance products purchased, including motor cover, will be subject to the Goods and Services Tax (GST) from April 1, 2015, BNM said.